3 Signs You’re About to Buy the Wrong Property on the Gold Coast

Relocating to the Gold Coast is an exciting step. For many buyers moving from interstate, New Zealand, or overseas, it represents a lifestyle upgrade, warmer weather, and long-term opportunity. But the same factors that make the Gold Coast appealing also make it one of the easiest property markets in Australia to get wrong.

The Gold Coast is not a single, uniform market. It is made up of tightly defined micro-locations where price, performance, and liveability can vary significantly from one street to the next. Two properties that look similar online can deliver very different outcomes once you factor in location, exposure, local behaviour and future risk.

Relocating buyers are particularly vulnerable to making the wrong choice. They are often time-poor, unfamiliar with local nuances, and under pressure to secure something quickly. Many only realise they made a mistake after they have moved in.

Here are three clear signs you may be about to buy the wrong property on the Gold Coast, and why independent, unemotional advice can prevent an expensive regret.

Most people who buy the wrong property do not realise it immediately. In fact, many initially love their purchase. The regret tends to surface later, once daily life sets in and issues emerge that were invisible during inspections.

Buyers often struggle to articulate why something feels wrong after the fact, but the same themes come up again and again.

Common reasons buyers later say they bought the wrong property

They felt rushed and made a decision based on fear of missing out

They compromised on their original wishlist and told themselves they would make it work

The location looked right on paper but did not suit daily life

Night-time noise or hooning was not apparent during inspections

Crime issues were more localised than suburb-wide statistics suggested

Traffic, parking or congestion was worse than expected

Flood exposure or insurance costs were higher than anticipated

Body corporate issues or rising fees emerged after settlement

They relied too heavily on selling agent information

They overpaid due to limited local knowledge

These regrets are common, and in many cases, avoidable. These regrets are common, and in many cases, avoidable. You can read more about this in What Selling Agents Don’t Tell Relocating Buyers on the Gold Coast.

1. You feel rushed and your original wishlist is starting to blur

One of the clearest warning signs is when urgency starts overriding your original criteria.

Relocating buyers are often told the Gold Coast market is extremely competitive and that hesitation will mean missing out. While some pockets do move quickly, urgency is frequently amplified by selling agents whose role is to create momentum, not to slow buyers down.

This is where buyers quietly start adjusting their wishlist. A less ideal location becomes acceptable. Noise concerns are rationalised. Layout compromises are downplayed. What once felt non-negotiable slowly becomes negotiable simply to secure a property.

Once urgency takes over, buyers are also less likely to question location risks, long-term costs, or whether the price truly makes sense.

Over time, these compromises rarely feel minor. A location that was meant to be temporary becomes frustrating. A noise issue that seemed manageable starts affecting sleep. A layout that “almost worked” becomes a daily inconvenience. These are not dramatic failures, but they quietly erode enjoyment and resale appeal, particularly for buyers who relocated with high lifestyle expectations.

It is also important to understand that the agent showing you the property is not an independent adviser. Selling agents are engaged by the seller and are legally and commercially focused on achieving the best possible outcome for that seller. While most act professionally, their role is not to assess whether a property is right for you, identify risks on your behalf, or negotiate in your interest.

A buyers agent exists to fill that gap. How I work with buyers is intentionally structured to be unemotional and detached from the property itself. They are unemotional and detached from the property itself. Their role is to keep bringing you back to your wishlist, challenge compromises made under pressure, and ensure decisions are aligned with your long-term goals rather than short-term fear.

2. You do not fully understand the hidden location and property risks

Many buyers focus on the home itself and underestimate how much risk sits beyond the four walls. On the Gold Coast, these risks are often highly localised and not obvious during inspections.

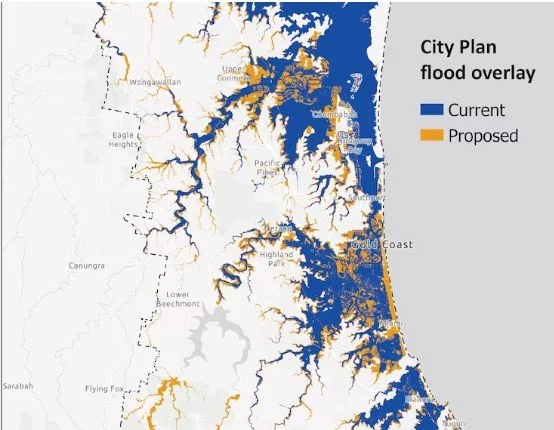

Flood exposure and storm tide risk are a prime example. Two streets apart can mean entirely different insurance outcomes, even if homes look identical. Some buyers only discover the true cost of flood overlays when insurance premiums arrive after settlement or when resale becomes more challenging due to buyer hesitation.

Bushfire risk is another factor that relocating buyers frequently overlook, particularly in hinterland-adjacent suburbs or areas backing onto reserves. Bushfire overlays can affect insurance, future renovations, and long-term desirability, yet they are rarely front of mind during an open home.

Future development is equally important. Views, light, privacy, and quiet streetscapes can change dramatically if nearby sites are zoned for higher density or commercial use. A property that feels private and open today may not stay that way. Selling agents are not required to proactively explain what may be built next door.

For apartments and townhouses, body corporate risk is one of the most common sources of buyer regret. Rising fees, deferred maintenance, building defects, special levies, and ongoing disputes often only become clear once owners are already committed. Meeting minutes and disclosure documents can be dense, and buyers unfamiliar with strata structures may not know what to look for or what should raise concern.

Then there are the lifestyle impacts that are easy to miss. Streets that feel quiet during daytime inspections may experience nighttime hooning. Traffic patterns can shift dramatically during school terms, holiday periods, or large events. These issues are rarely reflected in online listings or suburb-wide statistics, which is why local street-level insight matters.

A buyers agent looks at all of this holistically. They assess not just whether a property looks good today, but how its risks, surroundings, and governance are likely to affect daily life and long-term value. For relocating buyers, this local insight can be the difference between a property that simply looks right and one that genuinely works over time.

Gold Coast flood overlay map.

3. You are unsure whether the price and risk profile truly stack up

Price uncertainty is a major red flag, and it is rarely just about the number on the contract. It is usually a sign that buyers do not fully understand how price, risk, and long-term performance interact, or they are relying on incomplete information.

On the Gold Coast, pricing can vary significantly within the same suburb depending on street position, aspect, and exposure, but also due to factors that are not obvious at an open home, such as Gold Coast flood risk and body corporate issues. Two properties with similar asking prices can deliver very different long-term outcomes once you factor in insurance costs, governance, maintenance obligations, and future resale demand.

Buyers who are relocating often rely on a price guide or an online estimate without comprehending the underlying calculations. In practice, price guides can be optimistic, online estimates can lag behind market shifts, and broad suburb medians can hide meaningful differences between pockets, streets, and buildings. Comparable sales only help if they are genuinely comparable, in the same micro-location, with a similar land component, similar orientation, and similar risk profile.

This is how buyers accidentally overpay. They sometimes overpay, not because the property is generally "too expensive," but because they pay a premium unsupported by fundamentals. Sometimes the premium is tied to presentation rather than performance. Sometimes it is driven by urgency. And sometimes it comes from missing constraints that should affect value, such as higher insurance costs linked to flood overlays or limited demand due to body corporate issues like rising fees, deferred maintenance, disputes, or the risk of special levies.

Overpaying does not always feel like a mistake at purchase. It tends to show up later, through weaker capital growth, difficulty refinancing, or the need to discount when selling. Buyers may also feel trapped if they stretched their budget and then discover ongoing costs they did not factor in.

A buyers agent provides independent price guidance grounded in local evidence rather than marketing narratives. They test the price against true comparable sales, pressure-test the assumptions behind the guide, and assess whether flood exposure and strata governance risks are already reflected in the number. Most importantly, they negotiate unemotionally, so buyers are not paying a premium simply because they are tired of searching or emotionally attached to one option.

Why an unemotional buyers agent matters when relocating to the Gold Coast

Buying property is inherently emotional. It is tied to lifestyle, security, and future plans. That emotion can be powerful, but it can also cloud judgement, especially in an unfamiliar market.

A buyers agent works exclusively for the buyer. They are independent from selling agents and emotionally detached from individual properties. Their role is to slow decisions down when needed, challenge assumptions, uncover risks early, and continually test whether a property aligns with your wishlist, lifestyle needs, and long-term objectives.

Buying the wrong property on the Gold Coast rarely looks like a disaster on settlement day. More often, it is a slow realisation that something does not quite fit.

Independent advice early in the process can make the difference between confidence and regret.