Moving from New Zealand

to the Gold Coast

The complete guide for Kiwi families, professionals and couples starting a new chapter

Relocating from New Zealand to the Gold Coast is exciting, but it can also feel overwhelming. Many Kiwi families say that they don’t know where to begin with schools, suburbs, rental competition, buying rules, budgeting, and the logistics of moving countries.

This guide brings together everything you need to know before making the move. It reflects years of helping New Zealanders relocate to the Gold Coast, along with my own lived experience of making the same move. Whether you are seeking warmer weather, new opportunities, access to great schools, or a more affordable coastal lifestyle, this guide will help you move with confidence.

Why this guide is different

You will find plenty of general migration content online, but very little written specifically for Kiwi families relocating to the Gold Coast and even less with a property and suburb lens.

Unlike most relocation guides, this page focuses on the questions that truly shape your move: where to live, how to choose the right suburb, how much it will cost, whether to rent or buy, and how to avoid expensive mistakes when you cannot inspect everything in person.

For more detailed administrative steps, such as documents, banking, Medicare, and ID requirements, you can download my free International Relocation Playbook.

Who this guide is for

Kiwi families relocating for work or lifestyle

Couples wanting a warmer, easier lifestyle

Young professionals exploring new opportunities

Parents wanting better schooling options

Retirees or downsizers seeking simpler living

Anyone unsure whether to rent or buy first

Why so many New Zealanders choose the Gold Coast

The Gold Coast offers a combination that is hard to beat.

Warm weather and outdoor living

Excellent schooling options

Strong job market

Lower cost of living than Sydney or Melbourne

Lifestyle suburbs close to beaches, parks and waterways

A direct three-hour flight back to New Zealand

A large existing Kiwi community

The region’s growth has been strong for the past decade. Many Kiwi buyers tell me it feels like they are buying into a market with room to grow, compared to big Australian cities where prices are already out of reach.

The Gold Coast versus New Zealand

Key differences Kiwi families should understand

The Gold Coast feels familiar enough to settle quickly yet different enough that planning matters. These are the biggest contrasts that affect your move.

Property prices and value for money

Many Kiwi buyers are surprised by what their budget can achieve on the Gold Coast compared to Auckland, Wellington or Tauranga.

Detached homes in family suburbs are often more affordable than Auckland equivalents

Apartments vary widely depending on location, amenity, age and body corporate fees

Lifestyle suburbs such as Burleigh Waters or Helensvale feel premium but are still often cheaper than central Auckland coastal suburbs

Newer master-planned areas like Pimpama offer modern homes at prices that are hard to find in major NZ cities

Overall, the Gold Coast provides more diversity, more lifestyle choices, and more price range flexibility for Kiwi families.

Body corporate fees are normal in Australia

For Kiwi buyers, strata fees can feel unusual at first. On the Gold Coast, body corporate fees cover building insurance, maintenance, pools, lifts, gardens, and sometimes on-site management.

The level of amenity drives the cost

Smaller walk-up buildings might be low-fee

High-rises with lifts, pools and gyms have higher fees

Premium complexes with resort facilities cost more again

Many Kiwi buyers did not know to factor this in, and it can change your suburb and property choice significantly.

Building inspections are essential

Much more so than in NZ

Due diligence in Queensland is thorough and should never be skipped.

Key considerations

Pest inspections

Structural checks

Nearby development applications

Flood overlays and drainage risk

Road noise and flight paths

Strata records for apartments

These are not always obvious online, and they matter enormously on the Gold Coast.

Flood overlays affect whole pockets, not just individual houses

This is one of the most significant differences that Kiwi families underestimate. Entire streets, even entire suburbs, can have flood overlays that affect insurance costs, bank approval, and future resale.

Two streets apart can have completely different risk profiles, even if properties look similar in price and elevation.

This is why many Kiwi families choose to engage a buyers agent.

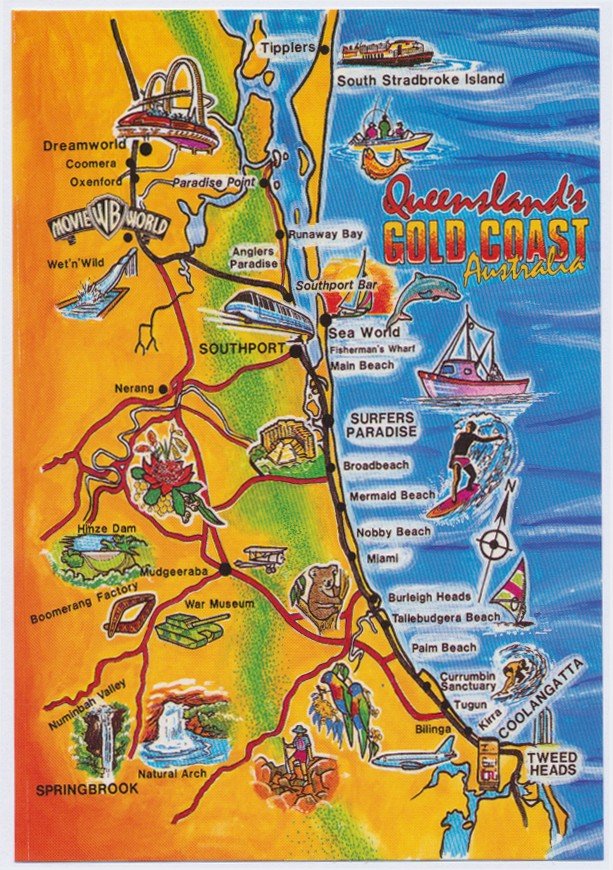

What Gold Coast suburbs feel like home for Kiwi’s

Here is a simple way to view the Gold Coast through a Kiwi lens

If you like Auckland’s North Shore

You may enjoy

Burleigh Waters

Varsity Lakes

Palm Beach

Beach lifestyle, cafes, schools, walkable pockets, and a strong community feel.

If you like the vibe of Tauranga or Mount Maunganui

Consider

Mermaid Waters

Currumbin

Burleigh Heads

Laid-back coastal living and a lifestyle built around walking, water, and dining.

If you are coming from Wellington

You might gravitate to

Mudgeeraba

Reedy Creek

Tallebudgera

Bush, hills, character homes, quieter streets, and fast access to coast, and hinterland.

If you prefer brand-new master-planned communities

Look at

Coomera

Pimpama

Ormeau

Newer builds, family-friendly estates, value for money and good school access.

Renting or buying first when you are moving from New Zealand

Many Kiwi families are unsure whether to rent or buy first. Both approaches work, but your timeline, appetite for risk and knowledge of the area matter.

Renting first works well if you

Want time to explore suburbs

Prefer to settle children in school before buying

Are arriving without knowing which area suits your daily life

Do not want pressure to pick a home quickly

Buying first works well if you

Already know the area

Want to avoid moving twice

Are comfortable buying with the support of a buyers agent

Want to secure a home before prices rise further

One of the most common mistakes is assuming rental competition works the same as in NZ. On the Gold Coast, rentals move quickly, and strong applications win.

If you are still weighing up whether to rent first or buy straight away, this Rent or buy first when you are relocating to the Gold Coast guide walks through the pros and cons in more detail.

Real experiences from Kiwi families I have helped

You can tell these stories in any way you prefer, but here are examples you can include.

A family from Auckland

They were relocating for a lifestyle change. With a budget in the mid $1M range, they wanted to be near good schools but close to the beaches. They initially believed they wanted Palm Beach, but after video walkthroughs and suburb comparisons, they realised Burleigh Waters offered better schools, quieter pockets, and more space. They bought without flying over again and settled perfectly.

A Tauranga couple

The couple had sold their home and wanted to live in an apartment near cafes and the beach. They were anxious about body corporate fees and buying off the plan. After reviewing three buildings and full strata reports, they chose a modern Broadbeach apartment with strong long-term value and reasonable fees.

A Wellington-based family

They wanted a larger block in a quiet area that still felt connected to green space. After shortlisting Mudgeeraba, Reedy Creek and Tallebudgera, we found a home backing onto bushland with walking access to schools. The family now says it reminds them of Wellington’s hills, but with much better weather.

If you would like to see how other Kiwi and interstate families have made the move successfully, you can explore my Client Stories for examples of the process and outcomes.

How much it costs to move from New Zealand to the Gold Coast

A realistic overview

Relocating countries involves more initial spending than most people expect.

Include costs for

Shipping or container

Flights

Temporary accommodation

Rental bond and advance

Utilities and household setup

Cars, licensing and insurance

School uniforms and supplies

Groceries and daily living

Initial medical and specialist costs

Transport and public services

For a full breakdown of expected expenses in your first few months, have a look at my relocation budget checklist for the Gold Coast.

For a step-by-step checklist covering paperwork, admin, and timing, you can download my International Relocation Playbook.

Schooling

Catchments matter more than in NZ. In Queensland, state schools operate strict catchment boundaries.

This is different from many NZ areas, where boundaries are more flexible.

Key considerations

You usually need proof of address before enrolment

Year entry points differ slightly from NZ

Commencing in January or July works best for transitions

School reputation affects property prices

The Gold Coast has strong public and private options depending on your needs

Renting on the Gold Coast

What Kiwi movers should expect: Properties move fast. Prepare your application before you land.

You will need

Employment evidence

Bank statements

Rental history

Identification

Short personal introduction

References from NZ landlords or employers

If you are overseas, a buyers agent can inspect rentals and advise on competitiveness.

Buying a home on the Gold Coast

Buying as a New Zealand citizen

What you need to know

New Zealand citizens can buy a home in Australia without FIRB approval and without Foreign Acquirer Duty, as long as they are physically in Australia and hold a Special Category Visa (SCV) at the time they sign the contract.

If you sign a purchase contract while still living in New Zealand, you are treated as a foreign buyer, which means

FIRB approval is required, and

Queensland’s Foreign Acquirer Duty (currently eight percent of the purchase price) will apply.

This catches many Kiwi buyers by surprise.

The good news is that you can still begin the buying process while you are in New Zealand. A buyers agent can

help you clarify your brief and choose suburbs

inspect and shortlist properties

complete due diligence and price research

line up a home you are ready to proceed with

Then, once you land in Australia and are granted your SCV on arrival, you can sign the contract here and avoid foreign buyer fees, as long as you are genuinely relocating.

I cover this in more depth in Buying on the Gold Coast from overseas, what you cannot see online, which explains the risks of relying solely on photos and listings.

Government schemes Kiwi buyers may access once in Queensland

This guide is written for Kiwi families relocating to Queensland, and especially the Gold Coast. Each state has its own rules, but once you are living here on a Special Category Visa (SCV 444) and buying a home to live in, you are generally treated much more like a permanent resident than a foreign buyer.

In Queensland, eligible New Zealand citizens may be able to access

Queensland First Home Owner Grant

If you are buying or building a new home under the current value cap, and at least one applicant is an Australian citizen or permanent resident, you may qualify for the First Home Owner Grant. New Zealanders on an SCV are usually treated as permanent residents for this purpose, provided all other criteria are met.

Queensland stamp duty concessions

When you buy a home to live in as your principal place of residence, you may be eligible for home and first home concessions on transfer duty, again subject to price caps and the usual occupancy rules. Once you are living here on an SCV and buying to occupy, you are not treated as a foreign purchaser in Queensland.

Federal Home Guarantee Scheme

Many Kiwi first-home buyers on an SCV, who meet the standard income, price, and eligibility criteria, can also access the Australian Government’s Home Guarantee Scheme. This includes the First Home Guarantee, Regional First Home Buyer Guarantee, and Family Home Guarantee, which can allow you to buy with a much smaller deposit than usual and avoid paying lenders mortgage insurance.

Rules differ between states. For example, New South Wales applies a 200-day residence test before some Kiwi buyers can avoid foreign purchaser surcharges. Queensland does not have this requirement, which is one reason many New Zealanders find the Gold Coast a more straightforward option when they are ready to buy.

Because schemes, thresholds, and eligibility criteria change over time, it is important to check the current rules and speak with a mortgage broker who understands New Zealand clients before you make any commitments.

Other practical things Kiwi families ask about:

Superannuation and KiwiSaver

When you move to Australia long-term, you will usually begin contributing to an Australian superannuation fund through your employer. Most Kiwi families keep their KiwiSaver account in New Zealand at first and build a separate super balance here, then decide later whether to consolidate or keep both. There are rules governing the transfer of some KiwiSaver balances into certain Australian super funds, but not all funds are eligible, and the tax and retirement implications can be significant.

Because the right approach depends on your age, long-term plans, and whether you might return to New Zealand, it is worth speaking with a financial adviser or accountant who understands both systems before you move large balances. These decisions sit alongside everything else you are planning for your move, such as budgeting, timing and paperwork. My International Relocation Playbook covers those broader relocation steps so you can see super and KiwiSaver in the context of your overall plan, and then work through the financial details with an adviser.

Healthcare and Medicare

New Zealand and Australia have a reciprocal health care agreement, and many New Zealand citizens who move here are able to enrol in Medicare once they meet the eligibility requirements. Even so, it is still common for families to keep or add private health cover, especially if they have ongoing medical needs, children with specialist care, or want greater choice of hospitals and doctors.

The practical steps include applying for a Medicare card soon after you arrive, choosing a local GP, understanding how prescriptions and referrals work, and deciding whether additional private cover makes sense for your family. I outline these steps, along with timing tips and a simple checklist, in my International Relocation Playbook, so you can work through them in order rather than trying to remember everything at once.

Licences, cars and ongoing costs

Most Kiwi relocators can drive on their New Zealand licence for a limited period in Queensland, but if you are settling here long-term, you will usually need to convert to a Queensland licence. There are fees for licence conversion, and car registration and compulsory insurance are often higher than people expect. If you are budgeting for your first six months, it is important to allow for licence costs, registration, insurance, and any safety checks if you are buying a used car.

Car ownership also affects your choice of suburb and weekly budget. Some families prefer to live close to work, schools, and public transport and keep to one car, while others are more comfortable in the hinterland or northern suburbs with two cars and a higher transport budget. I include licence, registration, and transport items in the budgeting and admin checklists in my International Relocation Playbook so that you can build these costs into your plan from the outset.

How a buyers agent helps Kiwi families

Clear, practical support when you cannot be here

This is one of the most important sections for conversions.

A buyers agent can

Assess suburbs that suit your budget, lifestyle and schooling needs

Attend inspections and provide detailed video commentary

Identify flood risks, development issues and noise concerns

Analyse strata records, body corporate fees and future liabilities

Provide independent price guidance and negotiation strategy

Manage contracts, due diligence, settlement and key handover

Coordinate your arrival timing and temporary stays

Prevent expensive mistakes caused by relying on online photos

Represent your interests when you cannot be physically present

Most Kiwi families I work with say the same thing: “There is no way we could have done this alone from overseas.”

You can read more about how I work with Kiwi clients on my Gold Coast buyers agent services page, or share your brief via my property wishlist form if you would like me to prepare a tailored shortlist.

See how I helped a Kiwi family secure a quiet Gold Coast hinterland retreat while living overseas

Your next steps

When you are ready to take the next step, here are your options.

Download the International Relocation Playbook

Full checklist, budgeting and admin guidanceTell me your brief using the Wishlist form

I will prepare a tailored shortlist for youBook a Let's Talk call

We will discuss your timeline, budget and options