Rent or buy first when you are relocating to the Gold Coast

Thinking of renting first to ‘learn the area’? Here’s how the numbers stack up on a $1.5 m target in today’s Gold Coast market.

A quick story to make it real

Emma and Max arrive from overseas with two school-age kids. They have pre-approved finance and a clear suburb shortlist near the tram line.

They have two paths:

Path one, rent for a year

They spend about sixty-three thousand dollars on rent for a home equivalent to one point five million in value. They learn the area, then try to buy later. If prices rise during that year, they miss the growth and still face the competition that pushed them to rent in the first place.

Path two, buy first and move once

They secure a home now, settle into school and work, and any growth belongs to them. They pay the upfront purchase costs and normal holding costs, then get on with life.

What the market is doing

“Aggressive offers are still the norm across key suburbs, with limited new supply adding to competition.”

This article explains that buyers are competing hard across South East Queensland, with multiple offers now standard on well-kept homes. Limited new listings and a wave of pre-approved buyers are keeping the pressure on. Read the article

CoreLogic indicates Gold Coast dwelling values rose about 80.7% over five years to Dec 2024 (≈12–13% p.a.). PropTrack shows prices up ~9% year-on-year to July 2025. PRD/APM median series for houses shows ~44.7% total over five years to Q2 2025 (≈8.9% p.a.). Figures vary by method, so use one series consistently.

This environment rewards buyers who move decisively, with finance in place and a clear brief.

Year-one breakdown on a $1.5 million home

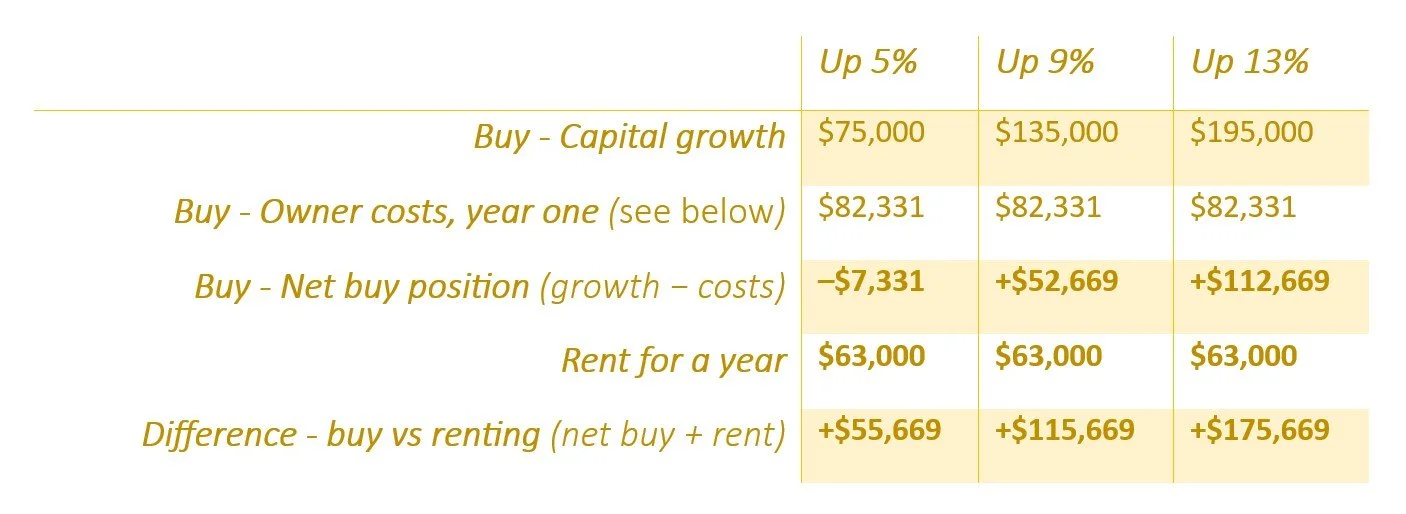

Net year-one outcomes. Buy now and move in uses capital growth minus owner costs. Rent shows twelve months of rent. Mortgage not included, so you can overlay your own loan. If prices don’t move (0%), buying is about $19,331 worse than renting in year one, and the break-even growth is ~5.5% on $1.5m.

-

QLD owner-occupier on a $1.5m home — no mortgage

Transfer duty — $59,600

Council rates and waste — $3,800

Water access — $1,200

Home insurance — $3,800

Maintenance allowance 0.5% — $7,500

Conveyancing and searches — $2,500

Building and pest — $650

Titles registration and incidentals — $1,831

Misc settlement costs — $450

Total — $82,331General information only, confirm figures for your contract date

Mortgage overlay for context

Interest-only estimates, shown to compare cost with rent on a like-for-like basis, excludes principal, fees, and any Lender’s mortgage insurance (LMI).

Mortgage overlay, interest-only estimates to help readers layer finance on the comparison.

We include the interest-only overlay as a quick cash-flow check. Many readers compare rent with full mortgage repayments and conclude renting is cheaper. That view mixes interest and principal together. Rent is a pure cost; every dollar leaves. Interest is the pure cost of owning; principal reduces your loan and becomes your equity. Comparing rent with interest-only keeps the comparison fair and shows that monthly outgoings are often similar. It does not change the wealth results above; it just answers the monthly affordability question.

Opportunity cost of renting

Rent near 4.2% yield on $1.5 million sits around $63,000 for the year.

If prices rise 5%, the missed capital gain is $75,000.

Combined impact of a rent year in that scenario, about $138,000 ($63,000 + $75,000).

At 9% growth, the missed gain is $135,000, and the total impact is about $198,000.

At 13% growth, the missed gain is $195,000, and the total impact is about $258,000.

What these figures are really saying is that renting for a year sets you back by the rent you pay plus the growth you miss.

So if you rent for a year and the market rises by 9%, you will spend about $63,000 on rent, and prices will rise about $135,000, so you will effectively have about $198,000 less to buy a home than if you bought straight away.

And if the market rises by 13%, you will still spend $63,000 on rent, but house prices will rise by about $195,000, so you will effectively have $258,000 less to buy a home than if you bought straight away.

“The bottom line is if you can afford it and plan to stay for a couple of years, buying straight away is a better option in the fast-paced Gold Coast market. You avoid a year of rent, capture any price growth, and only move once.”

How can I help you buy first with confidence

Buyers Advocacy

Brief, suburb plan, private or video inspections, price guidance, due diligence, offer and negotiation, contract to settlement

Premium Walkthrough

On-the-ground video with commentary for interstate and overseas clients

Family Relocation Concierge

School shortlist and enrolments aligned with your target suburbs and commute

Admin Fast Track

Banking and ID sequencing, utilities and internet, licence booking, smooth timing from key handover to move-in

Short-stay Setup

Serviced apartment near your chosen area for arrival week, timed with inspections or settlement

Ready to act

Let’s talk - book a quick call to map suburbs, timing, and first steps.

Send your wishlist - your must-haves, nice-to-haves, budget, and preferred suburbs.

General information for the Gold Coast, QLD. I am a licensed buyer’s agent and do not provide financial, credit, or tax advice. Figures are estimates based on stated assumptions and may change with market conditions. Please confirm finance and legal details with your mortgage broker and solicitor before you act.