Relocating to the Gold Coast: a realistic budget checklist

A practical checklist

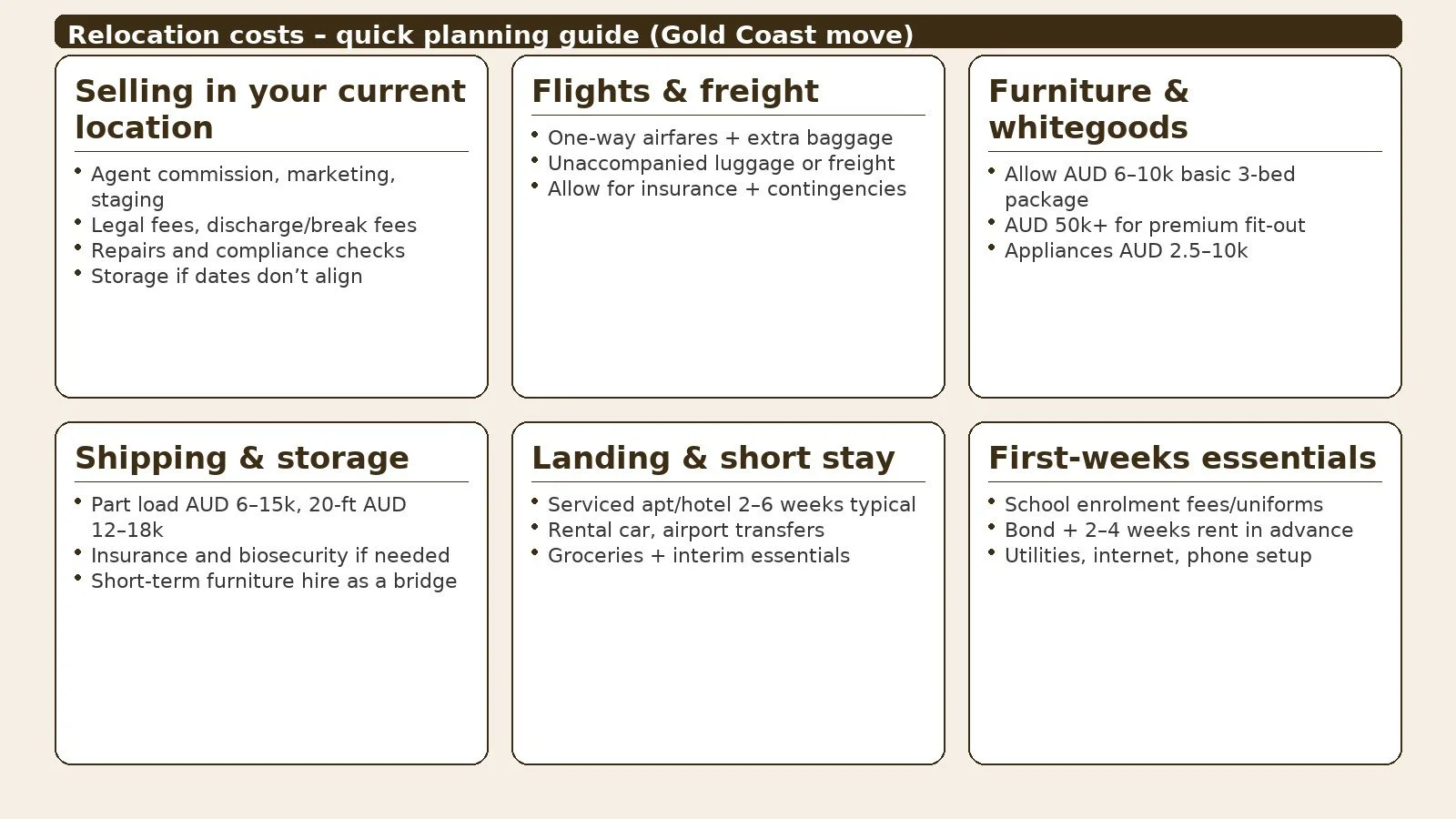

Relocating is exciting, but costs add up quickly if you do not map them early. Use this checklist to plan real numbers and keep a calm buffer if work is not locked in yet.

Selling in your current location

Agent commission, marketing, staging

Legal fees, mortgage discharge or break fees

Pre-sale repairs and compliance checks

Storage if dates do not align

Flights and freight

One-way airfares, extra baggage, unaccompanied luggage

International shipping or domestic removals, packing, insurance

Furniture and whitegoods

If changing style or moving to an apartment, buying on the Gold Coast is usually easier

Allow roughly AUD 6,000 to 10,000 for basic furniture for a three bedroom home

Allow up to AUD 50,00 or more for a more premium furniture package

Allow AUD 2,500 to 3,000 for essential appliances or up to AUD 10,000 for premium

Shipping and storage

International shipping part load often AUD 6,000 to 15,000. A 20 ft container often AUD 12,000 to 18,000, plus insurance or biosecurity if needed

Short term furniture hire can bridge a few weeks while you shop or wait for a shipment

Storage on either side if settlement or lease dates do not align

Landing and short stay

Serviced apartment or hotel for a period of time

Rental Car

Groceries and essentials

Renting a home

Rental bond, typically four weeks rent

Rent in advance, often two weeks

Utility connections, electricity, gas, internet

Contents insurance, any pet fees or cleaning

Application pack ready on day one, photo ID and proof of funds or employment

Buying a home

Deposit, building and pest inspection

Conveyancer or solicitor, searches and settlement adjustments

Transfer duty, lender fees, mortgage registration

Home insurance from unconditional date

Buyer’s agent fee if you engage one

Second removal if you rent first, reconnection costs

Gold Coast due diligence, flood checks and insurance quotes

Vehicles and transport

Car purchase or lease, stamp duty, registration, CTP

Insurance, toll account, public transport go card

If importing a car, include compliance, quarantine and registration steps

Kids and care

Childcare bond or enrolment fee, uniforms and supplies

School levies, uniforms, textbooks, laptop if required

Before and after school care setup

Life admin

Groceries and household setup, small appliances and furniture gaps

Phone plans and internet, mail redirection

Medicare, TFN, banking, licences and ID updates

Pet transport, registration, vet check and supplies

Banking and payments

Allow for FX margins and transfer fees if moving funds internationally

Contingency and income gap planning

If you do not have a job lined up, plan for 12 to 16 weeks of living costs to cover a typical search and onboarding

Minimum buffer three months of core expenses rent or mortgage, utilities, groceries, transport, insurance and schooling

Add a ten percent buffer across all one-off move costs

Keep at least one month of expenses in a fast-access account

If moving in peak season, add a peak pricing buffer. Short stay and car hire can add several thousand dollars over 2 to 4 weeks

Costs people forget

Peak season removalist surcharges

Strata or body corporate fees timing if buying an apartment

Locksmith and pest control on day one

Window coverings, whitegoods and outdoor items that do not fit the new home

Short notice pet boarding, quarantine or airline crate fees

Professional licences or blue cards if required for work

Seasonal pricing - summer and school holidays

Short stay and serviced apartments plus 20 to 60 percent in Dec to mid Jan, plus 80 to 120 percent over Christmas and New Year and school holidays

Holiday houses plus 40 to 100 percent in Dec to Jan, Easter, and school holidays

Rental cars often 2x off-peak in Dec to Jan and late September

Tips to reduce cost Book early, ask for weekly or monthly rates, widen the search beyond beachfront, and confirm inclusions such as parking, Wi-Fi, utilities, cleaning and linen

How to use this checklist

Turn each line into a line item with an estimate

Decide whether you will rent first or buy, then remove what does not apply

Add your contingency for income gaps and a ten percent buffer

If you want a calm second set of eyes on flood risk, strata health and value, I can help

I offer family relocation services at a reasonable cost. I am based on the Gold Coast and can be in Brisbane quickly if needed. See how I work and get in touch at jodenvirbuyersagent.com.au.

Jo Denvir Gold Coast Buyers Agent | Trusted Advocate for Premium Property Buyers