Should you rent or buy first when you are an international buyer on the Gold Coast

Moving to the Gold Coast from overseas raises a big question:

Is it safer to rent first or better to buy straight away?

If you already have permanent residency, this general guide on whether to rent or buy first when you are relocating to the Gold Coast, walks through the same question without the foreign buyer taxes.

For international buyers who are treated as foreign buyers, the choice is more complex. There are extra rules, extra taxes, and a real risk that prices keep rising while waiting for permanent residency.

This guide uses two simple price points:

$1,000,000

$1,500,000

and works through:

foreign buyer duty and FIRB fees

buying a completed new home

buying land and building

renting while the home is built

renting and land banking

how much savings are needed to make each option realistic

All dollar amounts in this article are in Australian dollars (AUD) unless stated otherwise. All figures are rounded, Gold Coast focused, and for illustration only.

Emily and Jack

Emily and Jack live in the United Kingdom with their 10 year old.

Jack is an engineer. Emily works in health. They own a home in the UK and after they sell, pay out their mortgage, and cover selling costs, travel and moving expenses, they expect to arrive on the Gold Coast with $600,000 in the bank.

They plan to move to the Gold Coast within the next year.

They are not Australian citizens or permanent residents, so at first they will be treated as foreign buyers. They are deciding between four paths.

Rent for a few years, then buy once they have permanent residency

Buy a completed new home now at around $1,000,000 or $1,500,000

Buy land now and build, aiming for a finished value of $1,000,000 or $1,500,000

Rent where they want to live, but buy land as a land bank

What changes when someone is a foreign buyer

When a family arrives without Australian citizenship or permanent residency, three key things usually change.

Established homes are off the table at first

From April 2025 to March 2027, most foreign buyers are banned from purchasing established dwellings, unless a limited exemption applies. They are generally limited to brand new dwellings or vacant residential land.

Approval is needed before buying

Foreign Investment Review Board approval is normally required before buying residential property, including vacant land and new homes. The application fee for new or vacant residential property is currently about $15,100 up to $1,000,000 and $30,300 up to $2,000,000.

Extra foreign buyer duty applies in Queensland

Queensland charges an Additional Foreign Acquirer Duty of 8 per cent on top of normal transfer duty when a foreign person buys residential land.

So the decision is no longer just rent versus mortgage. It is also about whether paying those extra foreign buyer costs now is worth it to get into the market earlier.

Base numbers at $1,000,000 and $1,500,000

To keep things simple, this blog uses two common price points for a Gold Coast home.

$1,000,000

$1,500,000

Indicative rent at a 4.2 per cent gross yield

On $1,000,000 – about $42,000 a year

On $1,500,000 – about $63,000 a year

Indicative first year owner costs for a local buyer

Around $55,000 on a $1,000,000 home

Around $82,000 on a $1,500,000 home

These owner costs include

normal transfer duty

council rates and water access

building insurance

routine maintenance

basic legal and settlement costs

They do not include loan interest.

For foreign buyers, the big extra pieces are

8 per cent foreign buyer duty on the price

FIRB application fees

Rounded foreign buyer costs on day one

$1,000,000 new home

Foreign buyer duty about $80,000

FIRB fee about $15,000

Combined extra foreign buyer costs about $95,000

$1,500,000 new home

Foreign buyer duty about $120,000

FIRB fee about $30,000

Combined extra foreign buyer costs about $150,000

Normal transfer duty still applies as well.

Before you decide whether to buy or rent, it is worth running through a realistic budget checklist for relocating to the Gold Coast so you know what cash you really have to work with.

Option 1 – Rent first

Under this option Emily and Jack rent for two or three years while they work towards permanent residency.

Once they become permanent residents they can

buy like locals

choose an established home in their preferred suburb

avoid foreign buyer duty on that purchase

The trade off is that every year they

pay rent

miss any capital growth on the home they hope to buy later

If prices move quickly, the home that felt affordable on arrival may be much harder to reach once they are finally ready to buy.

Option 2 – Buy a completed new home now

Here the family buys a completed new home in a new or near new estate as foreign buyers.

Year one at $1,000,000

Assumptions

Purchase price $1,000,000

Owner costs in year one about $55,000

Foreign buyer duty and FIRB together about $95,000

Rent on a similar home about $42,000

Year one comparison

Note

The tables in this article use the same growth trends discussed in Gold Coast home values jumping more than ten percent in a year, which shows how quickly budgets can go out of date.

These examples leave out mortgage interest and principal repayments on purpose. Interest costs and loan sizes vary a lot between buyers, especially for non residents and temporary visa holders. The tables are designed to show the trade off between rent, owner costs, foreign buyer taxes and capital growth. Your broker can then overlay the right loan structure for your situation.

Year one at $1,500,000

Assumptions

Purchase price $1,500,000

Owner costs in year one about $82,000

Foreign buyer duty and FIRB together about $150,000

Rent on a similar home about $63,000

Year one comparison

At both price points:

if growth is closer to 5 per cent, renting is ahead in year one

if growth is closer to 13 per cent, buying can already be ahead in year one

At zero growth, buying is much worse than renting in year one because of the extra foreign buyer costs.

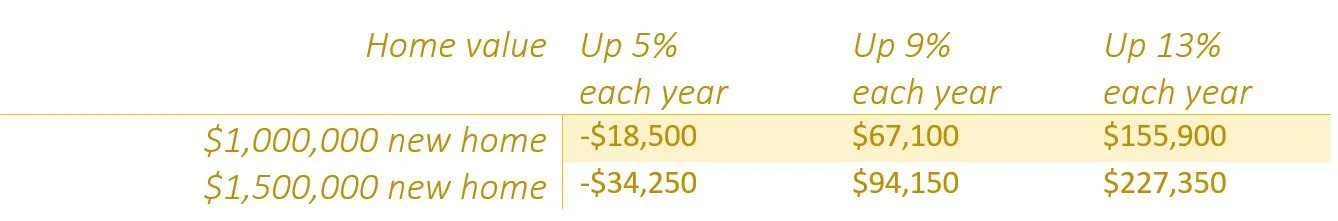

How the numbers look over two years

Foreign buyer costs are paid once. Capital growth and owner costs continue each year.

The table below shows the difference between buying and renting after two years, using the same assumptions.

Positive numbers mean buying is ahead. Negative numbers mean renting is ahead.

Two year difference – buy versus rent

So on these rough examples

at 5% annual growth, renting is still slightly ahead after two years

at 9% annual growth, buying is clearly ahead after two years

at 13% annual growth, buying is strongly ahead after two years

The break even point over two years is around 6% annual growth at both $1,000,000 and $1,500,000.

If you are house hunting from overseas, this guide on buying from interstate or overseas, what you cannot see online will help you avoid some nasty surprises.

Option 3 – Buy land now and build

Land and build behaves differently because foreign buyer duty and FIRB are calculated on the land price when it is bought, not on the full future value of the completed home.

Two simple targets

$1,000,000 finished home

$1,500,000 finished home

Possible splits

$1,000,000 home

Land $500,000

Build $500,000

$1,500,000 home

Land $750,000

Build $750,000

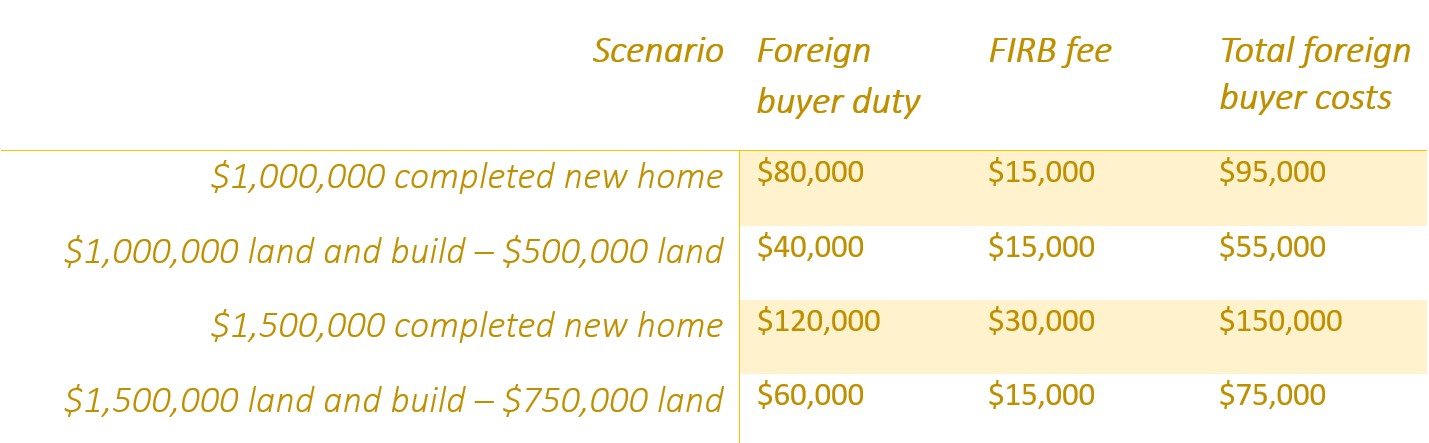

When the land is bought as a foreign buyer, approximate foreign buyer costs are

$500,000 land

Foreign buyer duty about $40,000

FIRB fee about $15,000

Combined foreign buyer costs about $55,000

$750,000 land

Foreign buyer duty about $60,000

FIRB fee about $15,000

Combined foreign buyer costs about $75,000

Compare those with the foreign buyer costs on completed new homes at the same finished values.

Foreign buyer duty and FIRB comparison

The land and build structure does not remove foreign buyer costs, but in these examples it roughly halves them, because tax is calculated on the land price instead of the full finished home value.

Normal transfer duty still applies on the land.

How long does the build take and what about rent

The tax saving is not free. While the home is being built, the family still needs somewhere to live.

Recent build timelines in Queensland suggest that

a standard four bedroom detached home commonly takes about 9 to 12 months from site start to completion

the total time from signing the build contract through approvals, finance and construction can easily run to 12 to 18 months

During this period they usually keep renting.

Using the earlier rent figures

Targeting a $1,000,000 build – rent about $42,000 a year

Targeting a $1,500,000 build – rent about $63,000 a year

So on the rough examples

at $1,000,000, the land and build structure might save around $40,000 in foreign buyer duty and FIRB compared with buying a completed new home, but a year of rent while the home is built costs roughly $42,000

at $1,500,000, the land and build structure might save around $75,000 in foreign buyer duty and FIRB, while a year of rent costs roughly $63,000

If land values and build contract prices rise during that time, the tax saving plus capital growth can more than cover the rent. If growth is weak and construction drags out, extra rent and holding costs can eat into the benefit.

Option 4 – Rent and land bank

There is also a halfway path between full buy and pure rent.

Under this approach a family

rents in the suburb and school catchment they want to live in now, and

buys a block of land in a growth estate as foreign buyers

The land does not give them a roof over their heads, but it keeps part of their savings invested in the market while they work towards permanent residency.

Using the $500,000 and $750,000 land examples

foreign buyer duty and FIRB are lower than on completed $1,000,000 and $1,500,000 homes

land in a well chosen estate can still benefit from general Gold Coast growth over three to five years

Once permanent residency is in place they can

sell the land and use the uplift as part of the deposit on an established home, or

keep the land and build on it as locals instead of foreign buyers

This strategy does not suit everyone. Land in fringe estates may not grow as strongly as established homes in blue chip suburbs, and there are still selling costs and build risks. It can, however, be a way to hold a foothold in the market while renting.

How much savings do you need at $1,000,000 and $1,500,000

The most common practical question for international buyers is how much cash they need to have before they can seriously consider buying.

Non resident and foreign buyer lending policies change often. Many lenders cap loans for non residents around 70-80% of the property value. Higher deposits are usually needed than for local buyers.

As a simple guide, the figures below assume

an 80% loan-to-value ratio

20% deposit

foreign buyer duty and FIRB as above

normal transfer duty at standard rates

about $5,000 for legal and settlement costs

Approximate minimum cash required at 80% loan-to-value

If a lender is only willing to go to 70% loan to value

the deposit on $1,000,000 rises to $300,000 and total cash needed can be in the low to mid $400,000s

the deposit on $1,500,000 rises to $450,000 and total cash needed can be in the mid $600,000s

These figures are broad guides only. Actual duty, foreign buyer duty and FIRB fees depend on the contract price, concessions and current rules.

For land and build structures, the overall cash requirement is often similar in total, but the foreign buyer duty and FIRB fee are charged on the land price instead of the full finished home value, which is where the saving comes in.

Gold Coast growth and time in the market

Gold Coast houses have grown at roughly 6-7% a year on average over the long term, with the past few years closer to 9-13% a year in many suburbs. That pace will not continue forever, but it shapes the rent-versus-buy decision.

Looking at the worked examples

at around 6% annual growth over two years, buying at both $1,000,000 and $1,500,000 roughly breaks even with renting, even with foreign buyer costs

at higher growth rates, such as 9-13% a year, buying tends to move clearly ahead of renting over a two-year period

land and build has a quicker payback than buying a completed home, because foreign buyer duty and FIRB are calculated on the land price rather than the full finished value

The shorter the stay and the lower the growth, the harder it is for a foreign buyer to beat renting after all upfront costs are accounted for. The longer the stay and the stronger the growth, the more powerful ownership becomes.

How to decide

There is no single right answer for international buyers who are treated as foreign buyers. The best option depends on visa timing, savings, income, and comfort with risk.

Buying now, as a completed new home or through land and build, tends to make more sense when:

there is a strong intention to stay on the Gold Coast

savings can comfortably cover both deposit and foreign buyer costs

starting in a new home in a growth corridor feels acceptable, even if the long-term dream is an established suburb (there are still pockets of land available in beach suburbs, but they come at a much higher cost)

Renting first tends to make more sense when:

there is doubt about staying in Australia long-term

savings are tight once foreign buyer costs are included

living in an established suburb is a priority, and there is patience to wait until permanent residency

Rent and land bank can be a middle path where:

the visa pathway will clearly take several years

there is capacity to hold both rent and land

the family wants some exposure to the market during that time

What makes sense for Emily and Jack

Emily and Jack have moved from the United Kingdom with healthy savings and a long term plan to settle on the Gold Coast. They are looking in the 1 million to 1.5 million range, and, for the first few years, they will be treated as foreign buyers.

The worked examples in this article show a few important things for them:

Foreign buyer duty and FIRB fees are a large upfront hit when they buy a completed new home, especially at one point five million

At long-term Gold Coast growth rates around 6-7% a year, buying can catch up with renting within 2-3 years, and at higher growth rates, buying pulls ahead much faster

With a solid deposit, the real constraint is how they structure the purchase and which price point they choose, not whether buying is possible at all

For Emily and Jack, buying now usually makes more sense than renting first because:

they are confident they want to stay on the Gold Coast for the medium to long term

their savings comfortably cover both the deposit and foreign buyer costs on a $1-1.5 million new home

they are open to a new home in a growth corridor, even if their forever suburb is different

In that scenario, getting into the market now lets them capture capital growth and avoid the risk that their preferred price bracket moves out of reach while they rent.

How a buyers agent can help

A local Gold Coast buyers agent with experience working with international clients can:

explain what is realistically possible under current foreign buyer rules at $1,000,000 and $1,500,000 budgets

model the difference between renting, buying a completed new home, buying land and building, and renting while land banking

shortlist suitable estates, blocks and build options that match budget, visa settings, work and school needs

coordinate inspections, due diligence and introductions to brokers, solicitors and other professionals

For families moving from the United Kingdom, Europe or elsewhere, early advice can prevent expensive surprises and help match the decision to rent or buy with the reality of foreign buyer rules and Gold Coast market conditions.

If you would like help weighing up these options, my full buyers advocacy service can walk you through the numbers for your situation from overseas through to settlement.

General information only, focused on Gold Coast, Queensland settings. This is not financial, credit, tax or legal advice. Foreign buyer rules, duty rates, FIRB fees, build times and lending policies change regularly. Personal advice from a registered migration agent, mortgage broker, accountant and solicitor is essential before making any decisions.